Are you tired of working the typical 9-to-5 job? Are you yearning for a more fulfilling and financially rewarding career path? Becoming a full-time landlord might just be the answer you’re looking for!

Becoming a full-time landlord can be a lucrative and rewarding career choice. Not only does it allow you to control your schedule, but it offers the potential for a stable income and long-term financial growth. In this post, we’ll discuss the essential steps to transition into a full-time landlord and create a successful rental property business.

Assessing Your Current Situation

Assessing your current situation is crucial in transitioning from a part-time to a full-time landlord. Understanding your position allows you to develop a realistic plan and successfully transition to full-time landlord status.

Evaluating Your Property Portfolio

Assess the current state of your rental properties. Here are some things to keep in mind:

- How many rental properties do you own, and how many units are in each?

- What is the current occupancy rate of each unit?

- Are the properties in good condition, or do they require maintenance or upgrades?

- Are there any outstanding legal or financial issues with the properties?

- How satisfied are the tenants with the properties and your management?

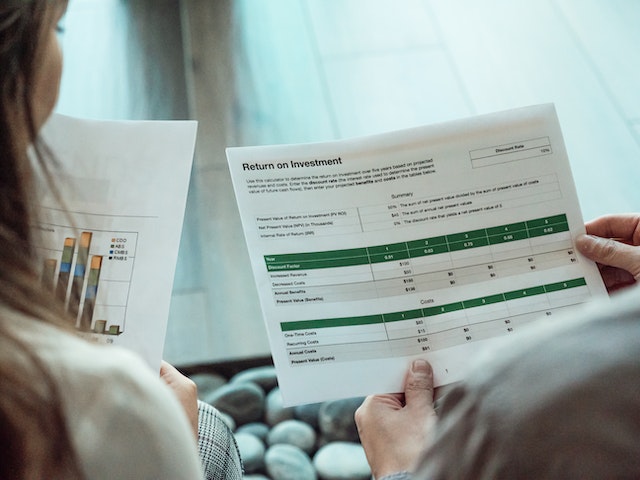

Assessing Your Financial Situation

Evaluate your financial position and determine whether you have the resources to become a full-time landlord. Consider the following questions:

- What is your current income from rental properties? Is it enough to support your lifestyle?

- Do you have any outstanding debt or financial obligations that would make transitioning to full-time landlord status difficult?

- Do you have a financial plan for the transition, including budgeting and investment strategies?

- Have you considered the potential risks and rewards of investing in real estate and how it aligns with your long-term financial goals?

Evaluating Your Time Commitments and Availability

Assess your current time commitments and availability, including other work or personal obligations. Identify the answers to these questions:

- How much time do you spend managing your rental properties?

- Do you have the flexibility to devote more time to managing your properties and growing your business?

- Have you considered outsourcing some of the tasks involved in property management, such as maintenance or tenant screening?

- How does managing rental properties align with your long-term career and lifestyle goals?

By evaluating your property portfolio, financial situation, and time commitments, you can develop a plan that considers your strengths and weaknesses as a landlord. This will help you create a roadmap to becoming a full-time landlord.

Developing a Business Plan

A business plan is a blueprint for your rental property business. It outlines your goals, strategies, and budget. The following tips will help you create an effective business plan:

- Define your short-term and long-term goals for your rental property business, including how many units you want to own, the amount of income you want to generate, and any other milestones you want to achieve.

- Create a realistic timeline for reaching your goals, such as acquiring new properties, managing your current properties, and making any necessary upgrades or repairs.

- Create a budget considering your current income, expenses, and financial goals. Include any costs associated with acquiring, managing, or upgrading new and current properties. Remember to account for any costs associated with renting out a furnished property, if applicable.

- Identify potential challenges and risks, like changes in the housing market, local regulations, or tenant turnover. Develop a plan for mitigating these risks and adapting to changing conditions.

Building a Support Network

Building a support network can help you navigate the challenges of being a full-time landlord and ensure you have the resources needed to succeed. You should be establishing relationships with real estate professionals, identifying resources for legal and financial advice, and creating partnerships with contractors and property management companies.

Marketing Your Rental Properties

Marketing your rental properties is crucial for attracting tenants and generating income. You should develop a marketing strategy that involves creating a strong online presence and maximizing rental income.

Tenant Management

Tenant management is a crucial aspect of being a full-time landlord. It involves finding and retaining high-quality tenants, responding to their needs, and maintaining a positive relationship with them. The following strategies will help you navigate tenant management:

- Develop a thorough screening process to ensure you rent to responsible, reliable tenants. This can include running background checks, credit checks, and verifying income and employment.

- Create a positive tenant experience by promptly responding to tenant needs, addressing maintenance issues, and communicating clearly.

- Develop a plan for managing tenant turnover, including filling vacancies quickly and efficiently and preparing units for new tenants.

Maintaining Your Properties

Maintaining your properties is essential to ensure they remain attractive to tenants and retain their value. Make sure you:

- Schedule regular inspections to identify any maintenance or repair issues before they become bigger, more expensive concerns.

- Develop a consistent maintenance plan that includes landscaping and cleaning. Complete any repairs or upgrades necessary to keep your properties in good condition.

- Hire reliable contractors to carry out maintenance and repairs. Ensure they provide competitive pricing and respond to your needs quickly.

Legal and Financial Considerations

It’s important to understand your financial and legal obligations as a full-time landlord. Take steps to protect yourself and your properties. Consider the following tips:

- Understand the local regulations for rental properties in your area, including landlord-tenant laws, zoning regulations, and building codes.

- Protect yourself and your properties with liability insurance and property insurance.

- Track your income and expenses carefully. This can help you make informed financial decisions and comply with tax regulations.

Conclusion

Becoming a full-time landlord is a significant investment of time, money, and effort. However, with careful planning and the right support network, it can be a profitable and fulfilling career. Following the steps outlined in this guide, you can successfully transition into a full-time landlord.

If you need further guidance, contact Young Management today! We’re a professional property management company with years of experience managing rental properties. Our team of experts can help you maximize your rental income and navigate the challenges of being a full-time landlord.